Pre-pandemic, businesses were already working through the challenges of a VUCA world – where volatility, uncertainty, complexity, and ambiguity in general conditions and situations were often seen. Faster technological changes, digitization, shortening product life cycles, rapid changes in consumer preferences, and political changes all contribute to this view.

The events of the last three years have created even more instability in Supply Chains, and resilience is now a key topic of debate. We can define resilience as the “capacity to recover quickly from difficulties,” but this implies a return to how things were rather than a new, constantly changing paradigm. It is the challenge of an increasingly uncertain future that forces the question of Supply Chains’ purpose and how they should be designed, governed, and operated to continue running productively in the face of whatever challenges are thrown at them.

Just as a ball will float in a storm on the sea, so must our Supply Chains! They need to be buoyant.

Purposeful Supply Chain design

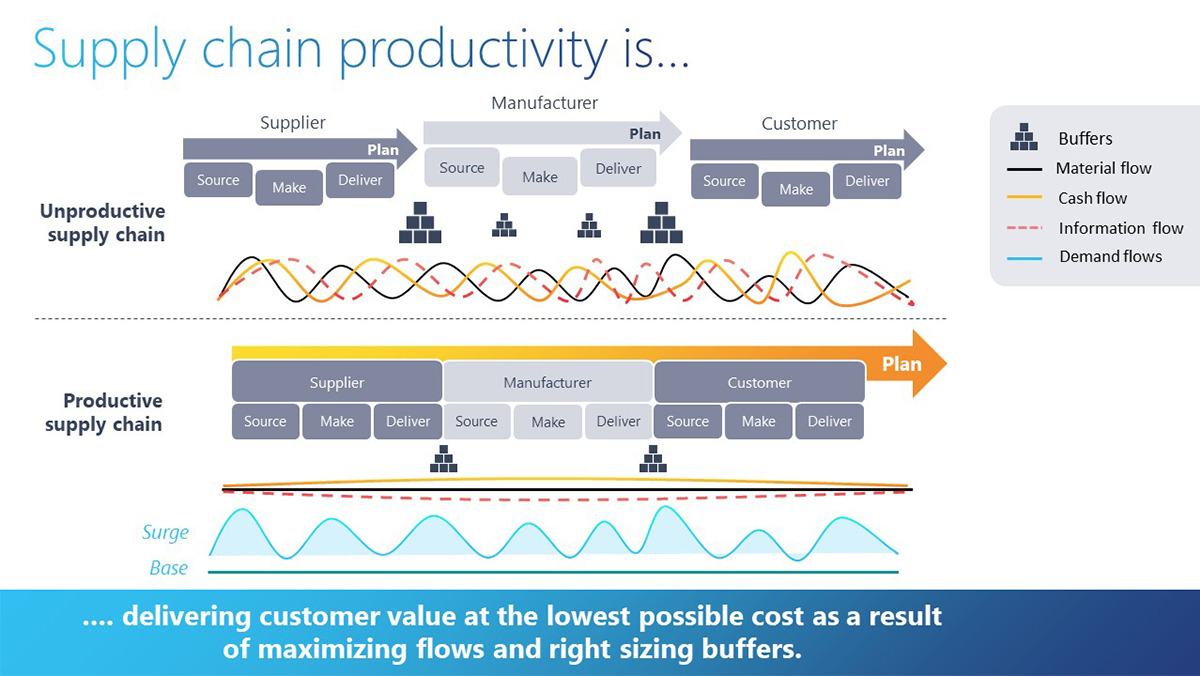

The purpose of a Supply Chain is to get products to people who need them, when they need them, and at an affordable price. This is the definition of a productive Supply Chain.

This should be done sustainably and responsibly. Supply Chains often operate in a non-responsible way, presenting numerous examples of unfairness in the distribution of value along the chain. The control of data and information is a key enabler of negotiating power plays between parties – it is incredibly challenging to get two entities to collaboratively plan just for mutual benefit.

Large enterprises often optimize their operations to the cost of their SME suppliers. From a Supply Chain finance perspective, the bigger players have better credit terms but pass the risk and costs to their supply base – increasing their own cost and risk and leaving the Supply Chain sub-optimized.

Key supply chain design considerations

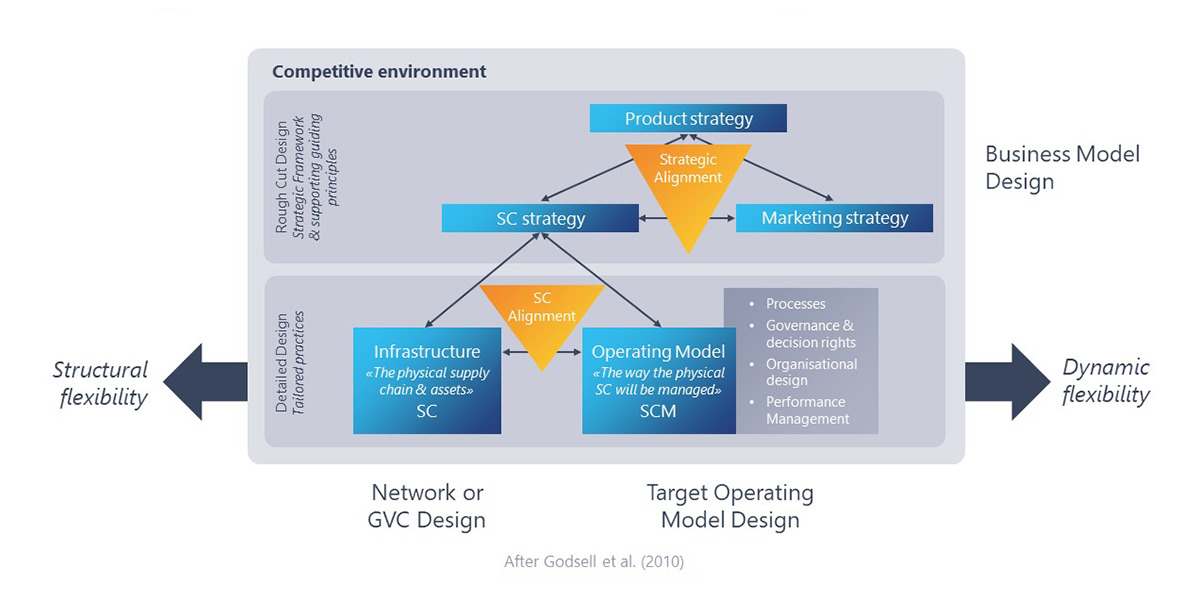

As part of a Business Model Design, product and marketing strategies should inform and drive Supply Chain strategy and ensure strategic alignment.

In a fast-moving consumer goods context, the Supply Chain design requirements for an everyday low-price (EDLP) pricing strategy with relatively stable demand differs from one with deep-dive Hi-Lo promotions and unpredictable demand. The challenge of the Supply Chain design is that within the life cycle of assets, a business may switch between EDLP and Hi-Lo many times. If the design is optimized for EDLP or has high predictability, there will be issues!

The design principles need to work through the infrastructure and operating model to deliver the necessary level of structural flexibility and dynamic flexibility.

Structural flexibility concerns the infrastructure and set-up of the physical Supply Chain and the assets. This includes:

- in-house capacity

- outsourced manufacture capability

- multiple supplier capability

- geographic location (in-country, near-shore, off-shore)

- the option to extend or move nodes in the supply chain.

Dynamic flexibility focuses on the operating model – how the physical assets will be managed. The model covers the following:

- business processes

- governance and decision rights

- organizational design

- performance management processes (e.g. who determines the levels of stock, where it should be held, and the approval processes for those decisions).

Orchestration and synchronization of the Supply Chain are critical enablers for ensuring it is as productive as possible. This is achievable by maximizing flow through the Supply Chain and rightsizing the buffers for stock and spare capacity.

Actions are driven from the source

The signal from the head of the chain closest to the point of final demand should drive actions across the whole chain. Essentially, interactions between business entities within the Supply Chain should be principally taken from a planning perspective rather than a procurement perspective.

There is a need to understand the constituent elements of the buying demand behavior, such as surge and base volumes, to inform the decisions taken in the chain. For example, increased demand for mobile phone gifts may be seasonally driven by Christmas versus purchases for birthday presents or end-of-contract replacements, which are more likely to be spread throughout the year.

A segmentation approach to the demand signal is required to determine the right supply action – an example being the setting of production wheels within a factory or a runners/repeaters/strangers approach to planning.

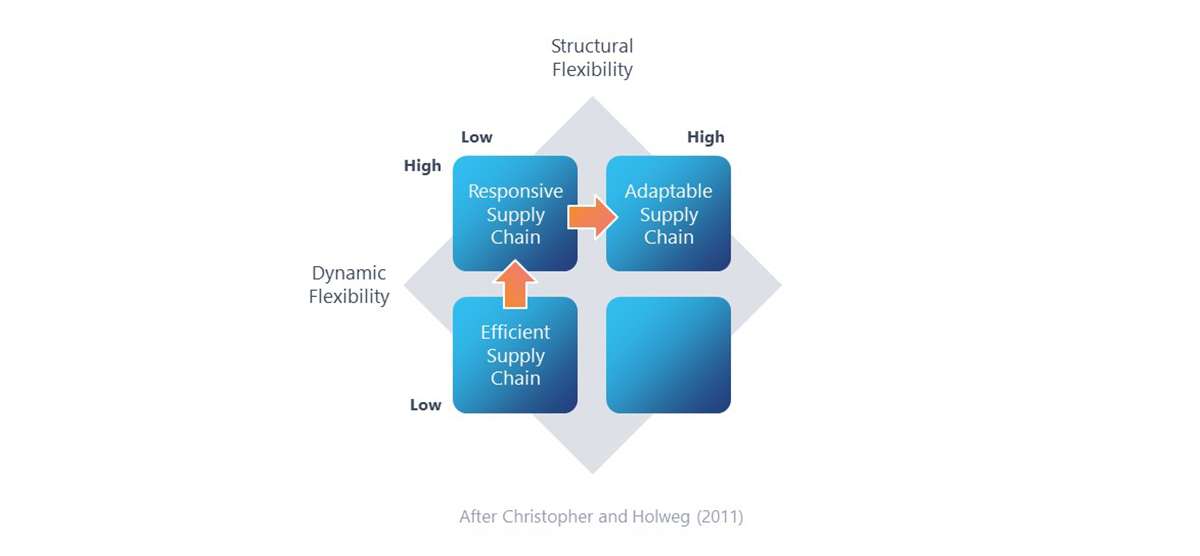

Decisions on the required level of dynamic and structural flexibility are critical for businesses. There is a direct cost for resilience as businesses choose to move to lower-cost, more efficient Supply Chains from ones more sensitive to shocks. The positive financial impacts are facilitated by delivering a more responsive approach. An adaptable Supply Chain model, in short, brings new capabilities into the network.

We can consider this cost in a similar way to an insurance premium. Business cases for resilience will be needed – but how is that developed, measured, and articulated against traditional business cases optimized to ROI cash? A traditional business case based on a single number and set of assumptions is inadequate for the unknown storms which may lie ahead. They must incorporate tolerance for different assumptions to give range and richness to thinking.

A balanced response enabling flexibility

Business processes need to develop. One example would be the S&OP process. A traditional S&OP process focuses on dynamic flexibility – aligning Sales and Supply Chain plans to meet demand – often over a relatively short time frame. So, what is the trigger for a structural network design change? How would a review of structural flexibility sit alongside the S&OP process?

Supplier resilience strategies also need development. If one of the needs for structural flexibility is multi-sourcing – how will volume be allocated? Will businesses pay for suppliers to be ready to supply (just in case they are needed), even in a high-inflation economy? Supplier relationship management will need to develop longer-term, more collaborative processes rather than playing a zero-sum transactional game where the price is the key focus.

Top tips for improving Supply Chain flexibility and resilience

So, what are the actionable insights?

- Commercial and Supply Chain Strategies need to work together over the lead time for structural flexibility.

- Creating the capability to react to unknown future Supply Chain shocks will increase upfront costs. This needs to be reflected in business cases. Scenario evaluation tools provide insight into the decision-making process.

- Design for uncertainty and segment the Supply Chain. Actively manage the inventory and capacity buffers to enable a stable beat.

- Collaboration for network orchestration, both within and between enterprises, needs visibility of data across end-to-end Supply Chains. The use of advanced planning systems is an enabler for decision-making. Procurement’s role and behavior are likewise critical to supplier relationship management.

- Businesses need to develop collaboration and governance processes for business process design and decision-making. Self-sufficient, empowered teams are enablers for dynamic flexibility.

One of the lessons from the last five years within Supply Chain management is that simply being resilient to recreate the previous conditions and Supply Chain set-up is no longer sufficient for future success. Teams constantly battle from one shock to another – and this is not sustainable. A reactive way of working creates burnout and costs businesses money.

Businesses must actively decide the right level of dynamic and structural flexibility they need. This creates the required capabilities, so they can bounce back from Supply chain Disruptions, use the next crisis to produce opportunities, and create competitive advantages.

Supply Chains need buoyancy, not just resilience.

Ready to learn more?

The insights in this blog are taken from our Innovating Profitable Manufacturing Supply Chains with Resilience webinar organised by

Board International. Watch it on-demand now to take a deeper dive!